All Categories

Featured

Table of Contents

A PUAR permits you to "overfund" your insurance coverage right as much as line of it ending up being a Modified Endowment Contract (MEC). When you use a PUAR, you quickly increase your money value (and your death advantage), consequently raising the power of your "bank". Even more, the even more cash money value you have, the higher your rate of interest and returns payments from your insurance provider will certainly be.

With the rise of TikTok as an information-sharing platform, monetary suggestions and methods have located an unique method of dispersing. One such strategy that has been making the rounds is the boundless financial idea, or IBC for short, garnering endorsements from celebrities like rap artist Waka Flocka Flame. Nonetheless, while the technique is currently popular, its roots map back to the 1980s when economic expert Nelson Nash presented it to the globe.

Is Self-financing With Life Insurance a better option than saving accounts?

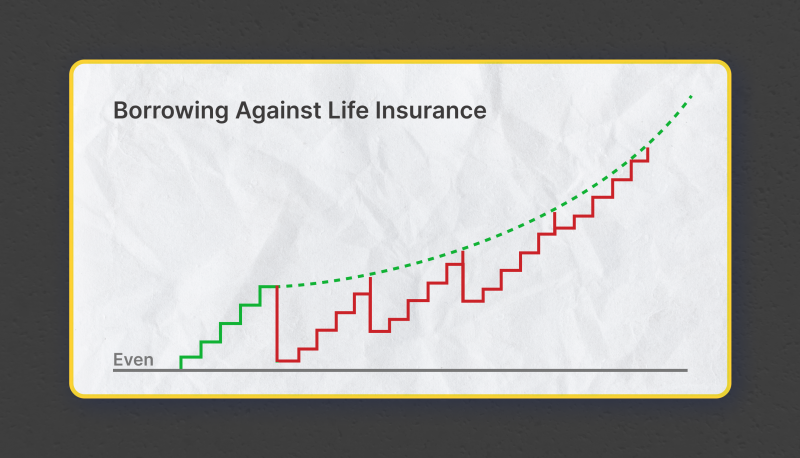

Within these plans, the cash money worth expands based on a price established by the insurer (Infinite Banking account setup). As soon as a considerable money worth collects, insurance policy holders can acquire a cash money worth loan. These fundings vary from traditional ones, with life insurance policy functioning as collateral, indicating one can shed their coverage if borrowing exceedingly without appropriate money value to support the insurance policy prices

And while the attraction of these policies appears, there are inherent restrictions and risks, demanding persistent cash money value surveillance. The approach's authenticity isn't black and white. For high-net-worth people or service proprietors, especially those making use of methods like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth can be appealing.

The appeal of unlimited banking does not negate its challenges: Cost: The fundamental requirement, a long-term life insurance plan, is pricier than its term equivalents. Eligibility: Not everyone receives entire life insurance due to rigorous underwriting procedures that can leave out those with details health and wellness or way of living problems. Complexity and threat: The detailed nature of IBC, combined with its risks, might prevent numerous, especially when less complex and much less risky options are readily available.

What are the common mistakes people make with Policy Loan Strategy?

Alloting around 10% of your monthly revenue to the policy is just not feasible for many people. Using life insurance coverage as an investment and liquidity source requires self-control and surveillance of plan cash money value. Speak with a monetary consultant to determine if unlimited banking lines up with your concerns. Part of what you read below is just a reiteration of what has actually currently been stated above.

Before you get yourself right into a situation you're not prepared for, understand the adhering to initially: Although the idea is typically marketed as such, you're not really taking a funding from yourself. If that were the situation, you would not have to repay it. Rather, you're obtaining from the insurance policy firm and have to repay it with rate of interest.

Some social media articles advise using cash money value from whole life insurance coverage to pay down credit score card financial obligation. When you pay back the lending, a section of that rate of interest goes to the insurance policy business.

For the first several years, you'll be paying off the commission. This makes it very hard for your policy to collect worth throughout this time. Unless you can manage to pay a couple of to a number of hundred bucks for the following decade or even more, IBC won't work for you.

How do I qualify for Bank On Yourself?

If you need life insurance coverage, right here are some useful tips to think about: Take into consideration term life insurance coverage. Make certain to go shopping around for the ideal price.

Picture never ever having to worry concerning bank car loans or high rate of interest rates once again. That's the power of unlimited financial life insurance policy.

There's no collection car loan term, and you have the liberty to choose the repayment routine, which can be as leisurely as repaying the car loan at the time of fatality. Infinite Banking benefits. This adaptability encompasses the servicing of the fundings, where you can select interest-only repayments, keeping the lending equilibrium flat and convenient

Holding money in an IUL fixed account being credited interest can commonly be much better than holding the cash money on deposit at a bank.: You have actually constantly imagined opening your own bakery. You can borrow from your IUL plan to cover the preliminary expenses of renting out a room, buying devices, and employing personnel.

What is Infinite Banking For Financial Freedom?

Individual car loans can be acquired from typical banks and credit unions. Right here are some essential factors to take into consideration. Charge card can give a versatile method to obtain cash for extremely short-term durations. However, borrowing cash on a charge card is generally very pricey with interest rate of interest (APR) commonly reaching 20% to 30% or even more a year - Life insurance loans.

Latest Posts

How To Be Your Own Bank With Whole Life Insurance

What Is Infinite Banking Life Insurance

Infinite Banking Testimonials