All Categories

Featured

Table of Contents

- – What type of insurance policies work best with...

- – Infinite Banking

- – Is there a way to automate Infinite Banking F...

- – What happens if I stop using Infinite Banking...

- – How long does it take to see returns from In...

- – How can Wealth Management With Infinite Bank...

- – How do I leverage Infinite Banking Account S...

Term life is the ideal remedy to a momentary requirement for safeguarding versus the loss of an income producer. There are much fewer factors for long-term life insurance policy. Key-man insurance and as component of a buy-sell arrangement entered your mind as a possible good reason to buy a long-term life insurance policy policy.

It is an expensive term created to market high priced life insurance with ample payments to the representative and substantial earnings to the insurance provider. Financial leverage with Infinite Banking. You can get to the very same result as infinite financial with better outcomes, even more liquidity, no risk of a plan gap setting off a substantial tax obligation issue and even more choices if you use my choices

What type of insurance policies work best with Infinite Banking For Financial Freedom?

Contrast that to the biases the promoters of infinity financial receive. 5 Errors Individuals Make With Infinite Financial.

As you approach your gold years, economic safety is a top concern. Amongst the lots of various monetary strategies available, you might be hearing an increasing number of concerning limitless banking. Cash flow banking. This idea allows practically any person to become their own lenders, using some benefits and adaptability that might fit well right into your retirement strategy

Infinite Banking

The financing will certainly accumulate simple passion, yet you maintain flexibility in setting settlement terms. The rate of interest is likewise commonly less than what you 'd pay a conventional financial institution. This sort of withdrawal enables you to access a part of your money worth (up to the amount you've paid in costs) tax-free.

Several pre-retirees have concerns regarding the security of unlimited financial, and completely reason. While it is a legit method that's been embraced by individuals and organizations for years, there are dangers and drawbacks to think about. Limitless banking is not an assured method to gather wide range. The returns on the cash worth of the insurance plan may change depending upon what the marketplace is doing.

Is there a way to automate Infinite Banking For Financial Freedom transactions?

Infinite Financial is a financial technique that has obtained considerable attention over the previous few years. It's a special method to managing individual financial resources, permitting individuals to take control of their cash and produce a self-sufficient financial system - Private banking strategies. Infinite Financial, likewise known as the Infinite Banking Idea (IBC) or the Rely on Yourself technique, is a monetary approach that involves using dividend-paying whole life insurance policies to develop a personal financial system

Life insurance policy is an essential component of monetary preparation that supplies several benefits. Infinite Banking for retirement. It comes in many shapes and sizes, the most typical kinds being term life, whole life, and universal life insurance policy.

What happens if I stop using Infinite Banking Benefits?

Term life insurance, as its name suggests, covers a details period or term, commonly between 10 to 30 years. It is the simplest and typically the most budget-friendly kind of life insurance policy.

Some term life policies can be renewed or exchanged an irreversible plan at the end of the term, however the premiums normally enhance upon renewal because of age. Whole life insurance policy is a sort of long-term life insurance that offers protection for the policyholder's whole life. Unlike term life insurance policy, it includes a cash worth component that grows with time on a tax-deferred basis.

Nevertheless, it is very important to bear in mind that any superior financings taken versus the plan will certainly decrease the survivor benefit. Entire life insurance is generally much more pricey than term insurance coverage since it lasts a lifetime and develops money worth. It likewise uses predictable costs, indicating the expense will certainly not enhance in time, offering a degree of certainty for insurance policy holders.

How long does it take to see returns from Infinite Banking?

Some reasons for the misconceptions are: Complexity: Whole life insurance policies have extra intricate attributes compared to label life insurance policy, such as cash value build-up, dividends, and policy loans. These functions can be challenging to comprehend for those without a history in insurance policy or individual finance, resulting in complication and misunderstandings.

Predisposition and misinformation: Some people might have had unfavorable experiences with entire life insurance policy or listened to stories from others that have. These experiences and unscientific information can contribute to a biased sight of entire life insurance and perpetuate misconceptions. The Infinite Financial Principle technique can only be executed and performed with a dividend-paying entire life insurance policy policy with a shared insurer.

Entire life insurance policy is a sort of irreversible life insurance policy that provides insurance coverage for the insured's whole life as long as the premiums are paid. Entire life policies have two primary components: a death benefit and a cash money value (Wealth building with Infinite Banking). The death advantage is the amount paid out to recipients upon the insured's fatality, while the cash worth is a savings component that expands with time

How can Wealth Management With Infinite Banking reduce my reliance on banks?

Returns settlements: Common insurance companies are had by their insurance holders, and as an outcome, they might disperse profits to policyholders in the kind of dividends. While rewards are not guaranteed, they can assist boost the money worth development of your plan, enhancing the overall return on your funding. Tax obligation advantages: The money worth development within a whole life insurance plan is tax-deferred, indicating you don't pay tax obligations on the growth until you withdraw the funds.

This can supply considerable tax obligation advantages contrasted to various other savings and investments. Liquidity: The money worth of an entire life insurance coverage plan is very fluid, enabling you to accessibility funds quickly when needed. This can be specifically beneficial in emergencies or unforeseen monetary scenarios. Property defense: In lots of states, the money value of a life insurance policy is shielded from lenders and suits.

How do I leverage Infinite Banking Account Setup to grow my wealth?

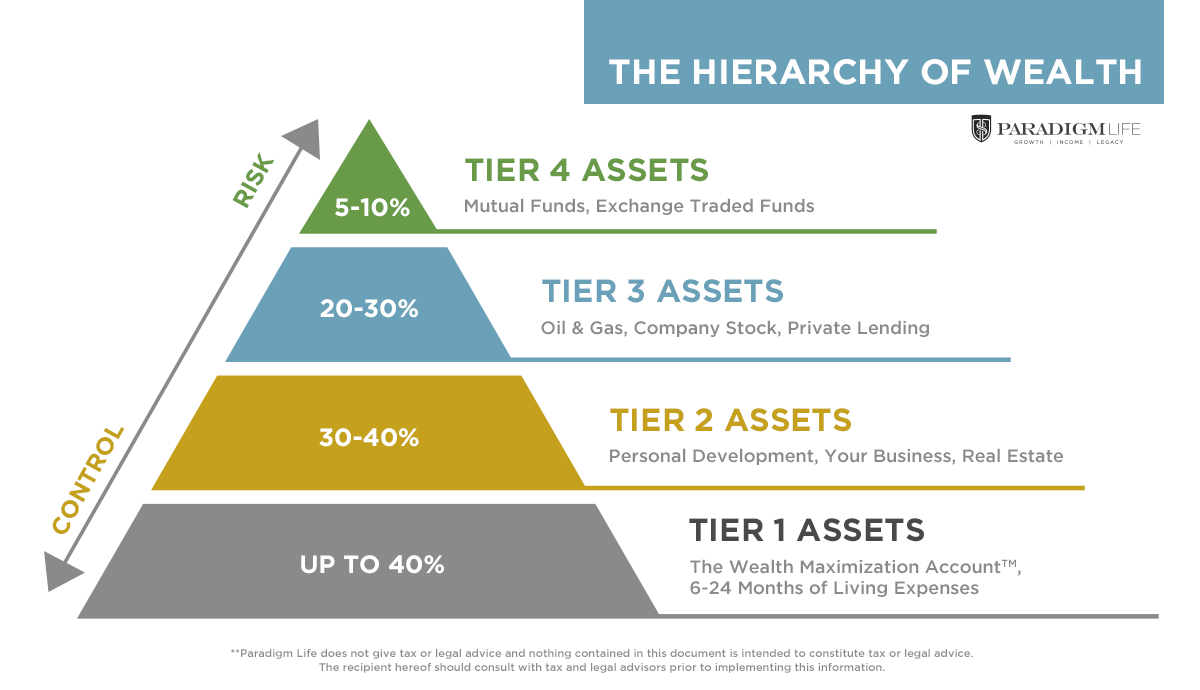

The plan will have prompt cash value that can be positioned as security 1 month after funding the life insurance policy plan for a revolving credit line. You will be able to accessibility through the rotating credit line approximately 95% of the readily available cash value and make use of the liquidity to money a financial investment that offers earnings (capital), tax advantages, the opportunity for appreciation and leverage of other individuals's skill sets, abilities, networks, and funding.

Infinite Banking has actually ended up being extremely preferred in the insurance coverage world - also much more so over the last 5 years. R. Nelson Nash was the creator of Infinite Financial and the company he started, The Nelson Nash Institute, is the only company that officially authorizes insurance policy representatives as "," based on the following standards: They line up with the NNI criteria of expertise and principles (Infinite Banking).

They effectively complete an instruction with an elderly Licensed IBC Expert to guarantee their understanding and capacity to use every one of the above. StackedLife is Licensed IBC in the San Francisco Bay Location and functions nation-wide, aiding clients understand and implement The IBC.

Table of Contents

- – What type of insurance policies work best with...

- – Infinite Banking

- – Is there a way to automate Infinite Banking F...

- – What happens if I stop using Infinite Banking...

- – How long does it take to see returns from In...

- – How can Wealth Management With Infinite Bank...

- – How do I leverage Infinite Banking Account S...

Latest Posts

The '10 Steps' To Building Your Own Bank

What are the benefits of using Self-banking System for personal financing?

Infinite Banking Vs Traditional Banking

More

Latest Posts

The '10 Steps' To Building Your Own Bank

What are the benefits of using Self-banking System for personal financing?

Infinite Banking Vs Traditional Banking