All Categories

Featured

Table of Contents

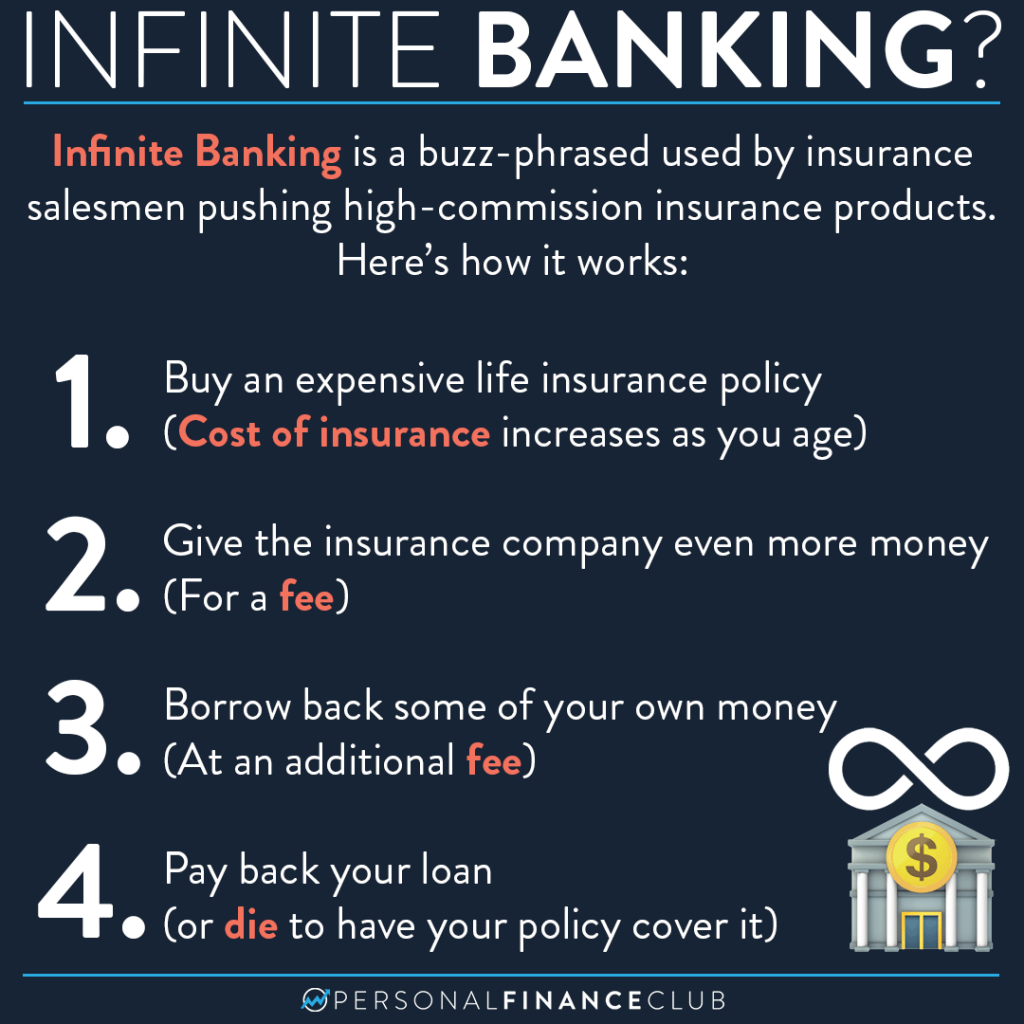

The method has its very own benefits, however it also has concerns with high charges, intricacy, and much more, resulting in it being considered as a scam by some. Limitless banking is not the best policy if you require only the investment element. The limitless financial principle focuses on making use of entire life insurance policy policies as a financial device.

A PUAR allows you to "overfund" your insurance policy right up to line of it ending up being a Changed Endowment Contract (MEC). When you make use of a PUAR, you swiftly enhance your cash money worth (and your survivor benefit), therefore raising the power of your "financial institution". Even more, the more money value you have, the greater your rate of interest and returns settlements from your insurer will be.

With the surge of TikTok as an information-sharing platform, economic recommendations and techniques have actually located an unique method of dispersing. One such strategy that has been making the rounds is the infinite banking idea, or IBC for short, gathering endorsements from celebs like rap artist Waka Flocka Flame - Infinite Banking vs traditional banking. Nevertheless, while the method is currently preferred, its roots map back to the 1980s when economist Nelson Nash introduced it to the globe.

How do I optimize my cash flow with Financial Independence Through Infinite Banking?

Within these plans, the money worth grows based upon a price established by the insurance firm. When a substantial cash value builds up, insurance policy holders can get a cash money worth financing. These finances vary from conventional ones, with life insurance acting as security, suggesting one might shed their coverage if loaning exceedingly without adequate cash value to support the insurance costs.

And while the attraction of these plans appears, there are inherent limitations and risks, requiring diligent money worth surveillance. The approach's authenticity isn't black and white. For high-net-worth people or business owners, specifically those utilizing strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and compound development might be appealing.

The appeal of unlimited financial doesn't negate its challenges: Expense: The foundational requirement, an irreversible life insurance policy policy, is pricier than its term counterparts. Eligibility: Not everyone receives whole life insurance policy as a result of strenuous underwriting processes that can leave out those with particular wellness or lifestyle conditions. Intricacy and threat: The detailed nature of IBC, coupled with its risks, may discourage several, especially when easier and much less dangerous choices are offered.

How do I qualify for Infinite Wealth Strategy?

Assigning around 10% of your monthly earnings to the plan is simply not practical for the majority of people. Using life insurance as an investment and liquidity resource needs discipline and tracking of policy cash worth. Get in touch with a financial consultant to determine if infinite financial straightens with your top priorities. Part of what you read below is just a reiteration of what has already been said above.

Prior to you obtain yourself into a circumstance you're not prepared for, recognize the adhering to initially: Although the principle is generally sold as such, you're not actually taking a funding from yourself. If that were the situation, you would not have to settle it. Rather, you're borrowing from the insurance company and have to repay it with interest.

Some social media blog posts advise using cash money value from whole life insurance to pay down bank card debt. The concept is that when you settle the financing with interest, the amount will certainly be sent out back to your investments. Sadly, that's not how it functions. When you pay back the car loan, a portion of that interest mosts likely to the insurance provider.

What resources do I need to succeed with Wealth Building With Infinite Banking?

For the first a number of years, you'll be repaying the compensation. This makes it very tough for your policy to gather value during this time. Entire life insurance expenses 5 to 15 times much more than term insurance policy. Most individuals just can't manage it. Unless you can afford to pay a few to numerous hundred dollars for the following years or more, IBC won't function for you.

Not everyone should rely exclusively on themselves for economic safety and security. Financial leverage with Infinite Banking. If you call for life insurance policy, below are some valuable tips to take into consideration: Consider term life insurance policy. These plans supply protection throughout years with significant monetary obligations, like home loans, pupil financings, or when caring for children. Ensure to go shopping around for the very best price.

What type of insurance policies work best with Infinite Banking?

Visualize never having to stress over small business loan or high rates of interest once again. Suppose you could borrow money on your terms and build wide range concurrently? That's the power of unlimited financial life insurance policy. By leveraging the cash worth of whole life insurance coverage IUL policies, you can grow your wide range and obtain money without counting on traditional banks.

There's no collection loan term, and you have the liberty to choose the payment routine, which can be as leisurely as repaying the financing at the time of death. This versatility reaches the servicing of the fundings, where you can choose interest-only payments, keeping the financing balance flat and convenient.

Is there a way to automate Infinite Banking Account Setup transactions?

Holding cash in an IUL dealt with account being attributed passion can frequently be far better than holding the cash money on down payment at a bank.: You have actually always imagined opening your own pastry shop. You can obtain from your IUL policy to cover the initial expenses of renting a room, acquiring devices, and hiring team.

Personal car loans can be obtained from typical banks and credit scores unions. Borrowing money on a credit rating card is usually very costly with yearly percentage rates of interest (APR) often reaching 20% to 30% or more a year.

Latest Posts

How To Be Your Own Bank With Whole Life Insurance

What Is Infinite Banking Life Insurance

Infinite Banking Testimonials